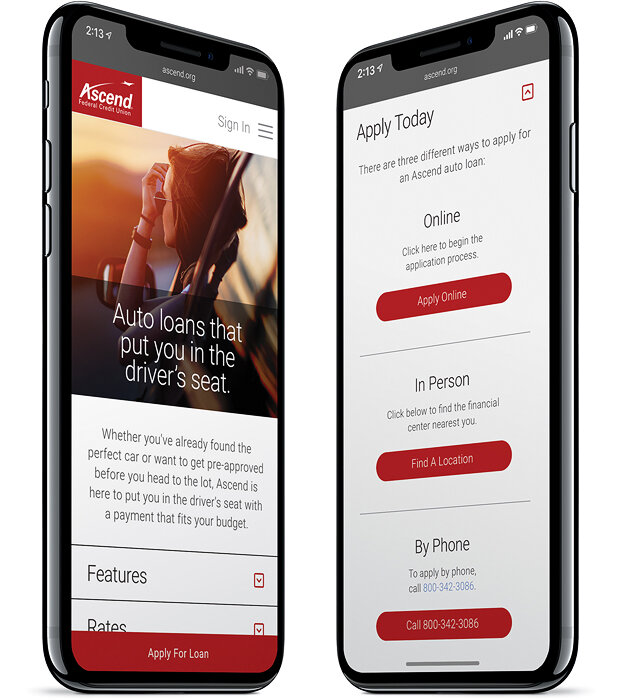

As more and more banking customers begin to prefer online interactions to branch visits, Ascend Federal Credit Union needed a website that could allow users to make major financial decisions from anywhere and on any device. That meant learning the unique sales process for each of their products and constructing pages that provided the right information at the right time to keep the user traveling down the sales funnel.

Credit unions are known for their not-for-profit structure, and most of them share profits with their members in the form of great rates on loans and deposits. But Ascend takes it a step further. They also share their profits in the form of a year-end cash giveback. The amount their members receive is based on how much they bank with Ascend. An industry-first calculator was developed to allow potential customers to find out how much they missed out on the previous year. Users can input the various banking products they use (or plan to use) and find out how much they could have earned and could expect to receive in the future by banking with Ascend.